Friday, March 31, 2017

Thursday, March 30, 2017

Wednesday, March 29, 2017

Tuesday, March 28, 2017

Monday, March 27, 2017

Sunday, March 26, 2017

Tuesday, March 21, 2017

4 Great Reasons to Buy This Spring!

4 Great Reasons to Buy This Spring!

4 Great Reasons to Buy This Spring! - Here are four great reasons to consider buying a home today instead of waiting.

1. Prices Will Continue to Rise

CoreLogic’s latest Home Price Index reports that home prices have appreciated by 6.9% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 4.8% over the next year.

The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense.

2. Mortgage Interest Rates Are Projected to Increase

Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage have remained around 4% over the last couple months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac & the National Association of Realtors are in unison, projecting that rates will increase by at least a half a percentage point this time next year.

An increase in rates will impact YOUR monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is necessary to buy your next home.

3. Either Way, You are Paying a Mortgage

There are some renters who have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent-free, you are paying a mortgage - either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing cost to work for you?

4. It’s Time to Move on with Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise.

But what if they weren’t? Would you wait?

Look at the actual reason you are buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer or you just want to have control over renovations, maybe now is the time to buy.

If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings.

To See More Blogs Like This One Please Visit My Website

For More Info Please Call 909-697-0823

or Visit

Monday, March 20, 2017

1445 W James St Rialto CA 92316 Coming Soon! By Celina Vazquez

Coming Soon!

www.1445wjamesst.com

Rialto, CA 92316

Gorgeous SFR 4BR/ 2BTH / 2-Car GR

Celina Vazquez Broker/Realtor represents this beautiful single story home located in the City of Rialto. Featuring 4 bedrooms, 2 bathrooms and 2-car garage with additional storage space. Large backyard and front yard fully landscaped.

Large kitchen with plenty of cabinet for all the pots and pans, large counters with seating overlooking the formal dining room. Large formal living room with cozy fireplace and all new interior paint and all new plush carpet.

Brand new windows all around, new interior paint, new flooring, new electrical and plumbing fixtures, this beauty was fully remodeled top to bottom.

Spacious patio and backyard, perfect for outdoor entertaining.

Parks like Anderson Park, Schools like Eisenhower High School are close by and convenient shopping centers. For more details or for showings contact Celina Vazquez at 909-697-0823 or celina@celinavazquezrealtor.com.

Sunday, March 19, 2017

Saturday, March 18, 2017

Friday, March 17, 2017

Thursday, March 16, 2017

Which Homes Have Appreciated the Most?

Which Homes Have Appreciated the Most?

Which Homes Have Appreciated the Most? - Home values have risen dramatically over the last twelve months. The latest Existing Home Sales Report from the National Association of Realtors puts the annual increase in the median existing-home price at 7.1%. CoreLogic, in their most recent Home Price Insights Report, reveals that national home prices have increased by 6.9% year-over-year.

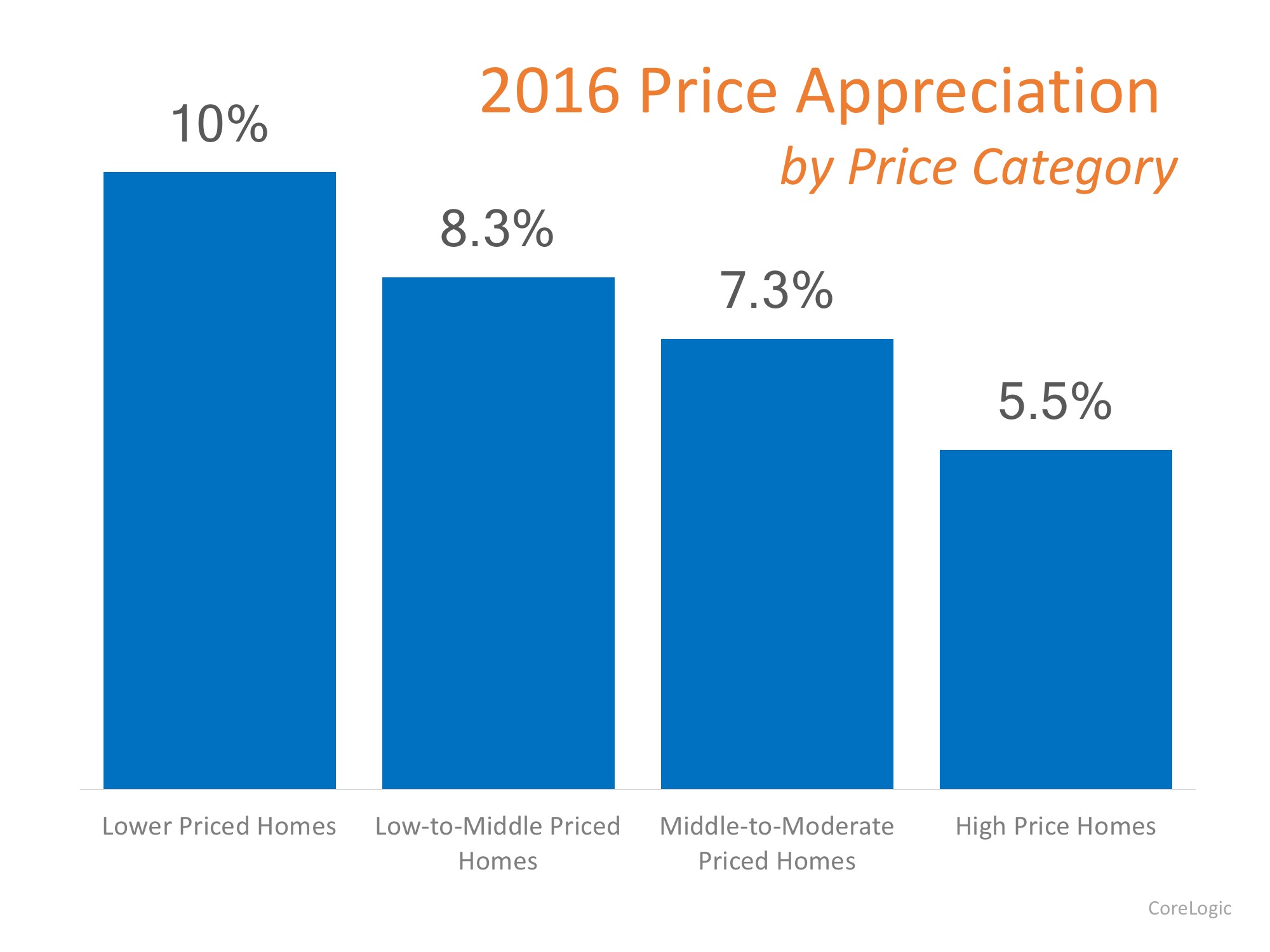

The CoreLogic report broke down appreciation even further into four different price categories:

- Lower Priced Homes: priced at 75% or less of the median

- Low-to-Middle Priced Homes: priced between 75-100% of the median

- Middle-to-Moderate Priced Homes: priced between 100-125% of the median

- High Price Homes: priced greater than 125% of the median

Here is how each category did in 2016:

Bottom Line

The lower priced homes (which are more in demand) appreciated at greater rates than the homes at the upper ends of the spectrum.

To See More Blogs Like This One Please Visit My Website

For More Info Please Call 909-697-0823

or Visit

Labels:

2016,

91752,

91764,

92336,

92336 For rent,

92337,

92376,

92507,

appreciated,

appreciation,

class,

home,

homes,

low,

middle,

most,

priced,

value

Wednesday, March 15, 2017

A Tale of Two Markets: Inventory Mismatch Paints a More Detailed Picture

A Tale of Two Markets: Inventory Mismatch Paints a More Detailed Picture

A Tale of Two Markets: Inventory Mismatch Paints a More Detailed Picture - The inventory of existing homes for sale in today’s market was recently reported to be at a 3.6-month supply according to the National Association of Realtors latest Existing Home Sales Report. Inventory is now 7.1% lower than this time last year, marking the 20th consecutive month of year-over-year drops.

Historically, inventory must reach a 6-month supply for a normal market where home prices appreciate with inflation. Anything less than a 6-month supply is a sellers’ market, where the demand for houses outpaces supply and prices go up.

As you can see from the chart below, the United States has been in a sellers’ market since August 2012, but last month’s numbers reached a new low.

Recently Trulia revealed that not only is there a shortage of homes on the market in general, but the homes that are available for sale are not meeting the needs of the buyers that are searching.

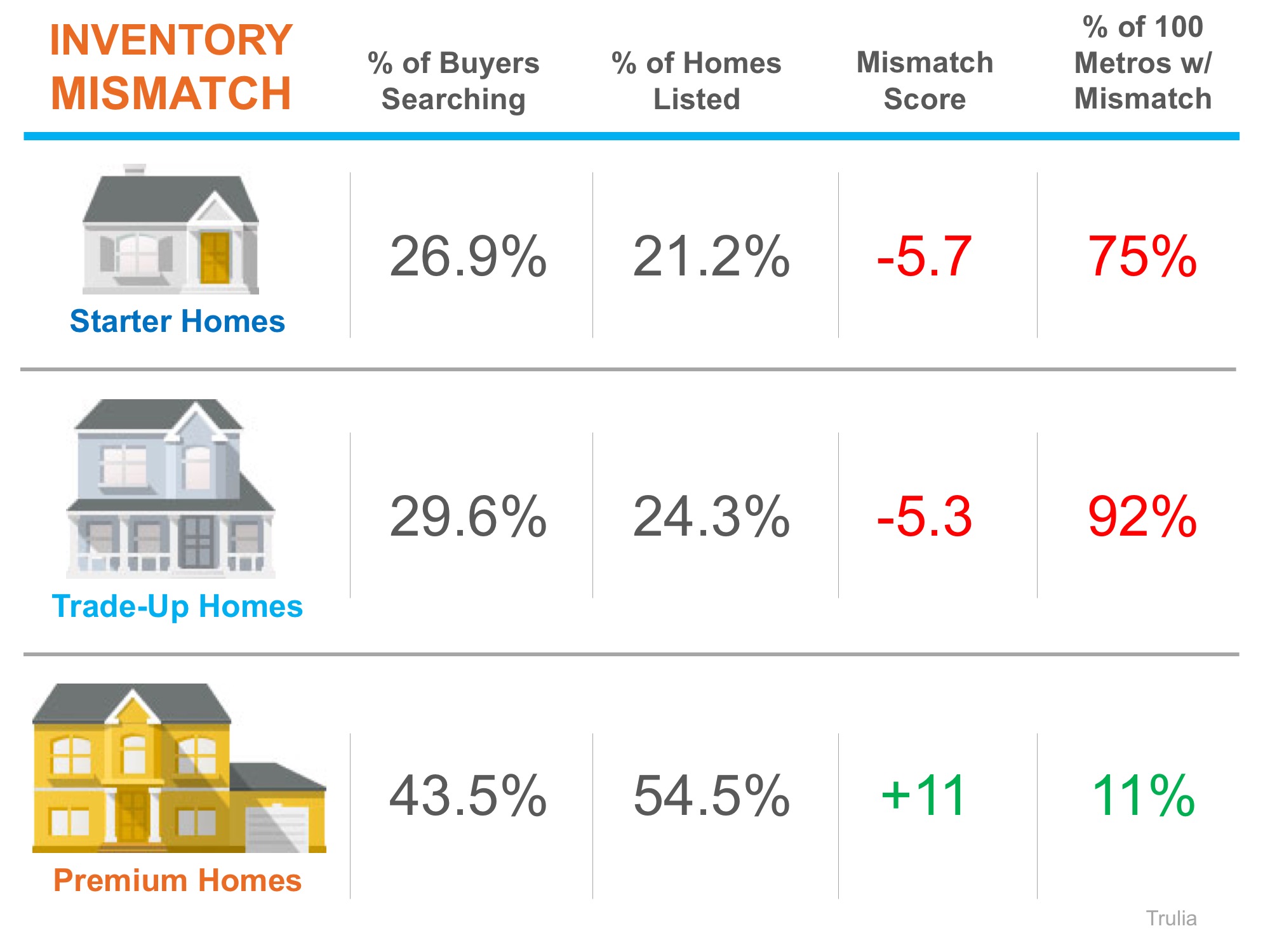

Homes are generally bucketed into three groups by price range: starter, trade-up, and premium.

Trulia’s market mismatch score measures the search interest of buyers against the category of homes that are available on the market. For example: “if 60% of buyers are searching for starter homes but only 40% of listings are starter homes, [the] market mismatch score for starter homes would be 20.”

The results of their latest analysis are detailed in the chart below.

Nationally, buyers are searching for starter and trade-up homes and are coming up short with the listings available, leading to a highly competitive seller’s market in these categories. Ninety-two of the top 100 metros have a shortage in trade-up inventory.

Premium homebuyers have the best chance of less competition and a surplus of listings in their price range with an 11-point surplus, leading to more of a buyer’s market.

“It leaves Americans who are in the market for a home increasingly chasing too fewer options in lower price ranges, and sellers of premium homes more likely to be left waiting longer for a buyer.”

Lawrence Yun, NAR’s Chief Economist doesn’t see an end to this coming any time soon:

“Competition is likely to heat up even more heading into the spring for house hunters looking for homes in the lower- and mid-market price range.”

Bottom Line

Real estate is local. If you are thinking about buying OR selling this spring, let’s get together to discuss the exact market conditions in your area.

To See More Blogs Like This One Please Visit My Website

For More Info Please Call 909-697-0823

or Visit

Labels:

blog,

broker,

buyers,

celina,

homebuyers,

homeowners,

homes,

inventory,

market,

markets,

mismatch,

NAR,

national association of realtors,

picture,

realtor,

sllers,

trulia,

vazquez

Tuesday, March 14, 2017

Mortgage Interest Rates Went Up Again… Should I Wait to Buy?

Mortgage Interest Rates Went Up Again… Should I Wait to Buy?

Mortgage Interest Rates Went Up Again… Should I Wait to Buy? - Mortgage interest rates, as reported by Freddie Mac, have increased over the last several weeks. Freddie Mac, along with Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors, is calling for mortgage rates to continue to rise over the next four quarters.

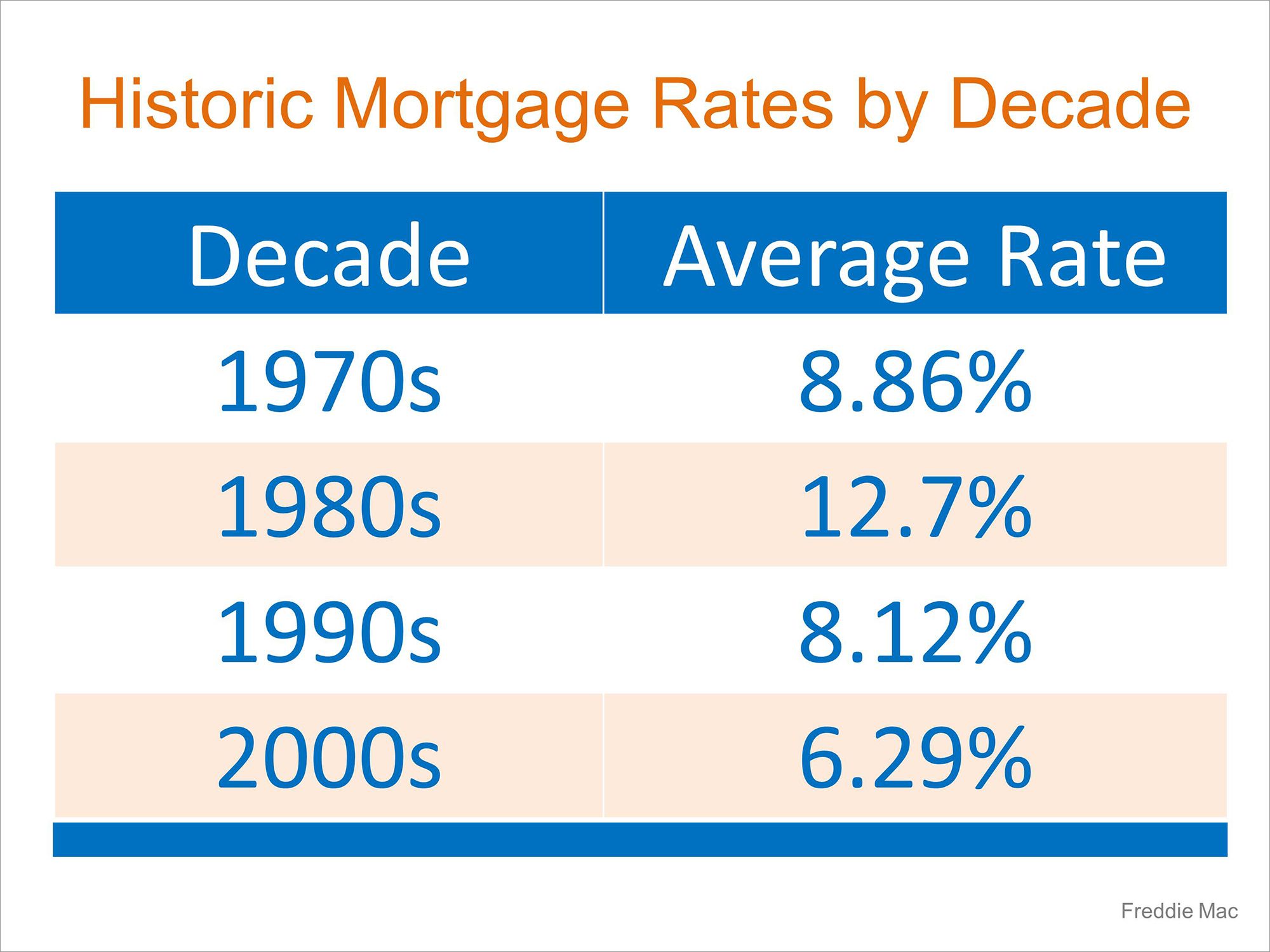

This has caused some purchasers to lament the fact they may no longer be able to get a rate below 4%. However, we must realize that current rates are still at historic lows.

This has caused some purchasers to lament the fact they may no longer be able to get a rate below 4%. However, we must realize that current rates are still at historic lows.

Here is a chart showing the average mortgage interest rate over the last several decades.

Bottom Line

Though you may have missed getting the lowest mortgage rate ever offered, you can still get a better interest rate than your older brother or sister did ten years ago, a lower rate than your parents did twenty years ago, and a better rate than your grandparents did forty years ago.

To See More Blogs Like This One Please Visit My Website

For More Info Please Call 909-697-0823

or Visit

Monday, March 13, 2017

How to Get the Most Money When Selling Your Home

How to Get the Most Money When Selling Your Home

How to Get the Most Money When Selling Your Home - Every homeowner wants to make sure they get the best price when selling their home. But how do you guarantee that you receive maximum value for your house? Here are two keys to ensuring you get the highest price possible.

1. Price it a LITTLE LOW

This may seem counterintuitive. However, let’s look at this concept for a moment. Many homeowners think that pricing their home a little OVER market value will leave them room for negotiation. In reality, this just dramatically lessens the demand for their house (see chart below).

Instead of the seller trying to ‘win’ the negotiation with one buyer, they should price it so that demand for the home is maximized. By doing this, the seller will not be fighting with a buyer over the price, but will instead have multiple buyers fighting with each other over the house.

Realtor.com gives this advice:

“Aim to price your property at or just slightly below the going rate. Today’s buyers are highly informed, so if they sense they’re getting a deal, they’re likely to bid up a property that’s slightly underpriced, especially in areas with low inventory.”

2. Use a Real Estate Professional

This, too, may seem counterintuitive, as the seller likely believes that he or she will net more money if they don’t have to pay a real estate commission. With that being said, studies have shown that homes typically sell for more money when handled by a real estate professional.

Research posted by the National Association of Realtors revealed that:

“The median selling price for all FSBO homes was $185,000 last year. When the buyer knew the seller in FSBO sales, the number sinks to the median selling price of $163,800. However, homes that were sold with the assistance of an agent had a median selling price of $245,000 – nearly $60,000 more for the typical home sale.”

Bottom Line

Price your house at or slightly below the current market value and hire a professional. This will guarantee that you maximize the price you get for your house.

To See More Blogs Like This One Please Visit My Website

For More Info Please Call 909-697-0823

or Visit

Saturday, March 11, 2017

Friday, March 10, 2017

Spring Forward: The Difference An Hour Makes

Spring Forward: The Difference An Hour Makes

Some Highlights:

- Don’t forget to set your clocks forward this Sunday, March 12th at 2:00 AM EST in observance of Daylight Savings Time.

- Unless of course, you are a resident of Arizona or Hawaii!

- Every hour in the United States: 649 homes are sold, 177 homes regain equity (meaning they are no longer underwater on their mortgage), and the median home price rises $1.86!

To See More Blogs Like This One Please Visit My Website

For More Info Please Call 909-697-0823

or Visit

Subscribe to:

Comments (Atom)